Homeowners Insurance in and around Lexington

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Your house isn't a home unless you enjoy coverage from State Farm. This magnificent, secure homeowners insurance will help you protect what you value most.

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Agent Misty Stathos, At Your Service

Are you looking for a policy that can help insure both your home and your memorabilia? State Farm agent Misty Stathos's team is happy to help you develop a policy that's right for your needs.

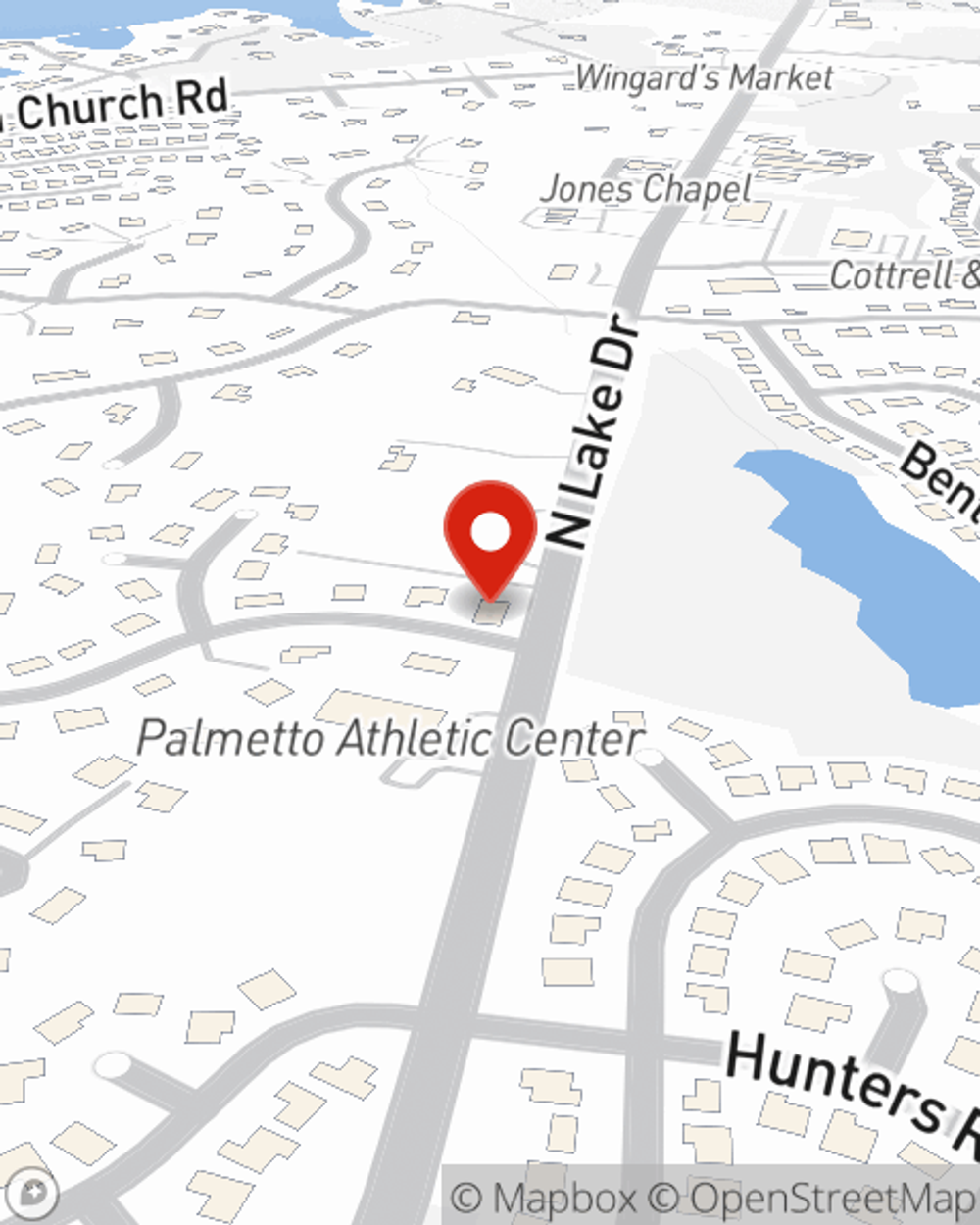

Having quality homeowners insurance can be invaluable to have for when the unpredictable happens. Visit agent Misty Stathos's office today to put together the right home policy.

Have More Questions About Homeowners Insurance?

Call Misty at (803) 951-9151 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips to deal with most common home emergencies

Tips to deal with most common home emergencies

Do you have an effective emergency management plan? Here are step-by-step instructions to deal with common home emergencies.

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.

Misty Stathos

State Farm® Insurance AgentSimple Insights®

Tips to deal with most common home emergencies

Tips to deal with most common home emergencies

Do you have an effective emergency management plan? Here are step-by-step instructions to deal with common home emergencies.

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.